Taxation policy of Mughals in Bengal was executed through Nawabs who in turn collected taxes through zamindars. In the middle of the eighteenth century the flow of funds diminished. This was because of the deal that was signed by Murshid Quli Khan with the imperial administration. Thereafter Bengal was no longer supported by troops. The Mughal dignitaries also never allocated revenue from land as jagirs. The Nawab therefore took the Jagir lands. The jagirs that were granted for Bengal were transferred to Orissa where their holders had to struggle to raise sufficient revenue. Technically one-quarter of Bengal`s revenue were assigned to Jagirs. However the allocations were for the costs of Bengal`s government, defence and for the personal expenses of the Nawabs.

Taxation policy of Mughals in Bengal was executed through Nawabs who in turn collected taxes through zamindars. In the middle of the eighteenth century the flow of funds diminished. This was because of the deal that was signed by Murshid Quli Khan with the imperial administration. Thereafter Bengal was no longer supported by troops. The Mughal dignitaries also never allocated revenue from land as jagirs. The Nawab therefore took the Jagir lands. The jagirs that were granted for Bengal were transferred to Orissa where their holders had to struggle to raise sufficient revenue. Technically one-quarter of Bengal`s revenue were assigned to Jagirs. However the allocations were for the costs of Bengal`s government, defence and for the personal expenses of the Nawabs.

The zamindars were a major source of income. Zamindars had a right to collect tax and it was their duty to pass part of it on to the government. The collection of taxation became an exercise of some degree of authority over those who paid it. It was accepted that those who assumed them should not be deprived without due cause. Where they were dispossessed they were permitted to an allowance as compensation. Zamindari rights had become inherited. They could be bought and sold. The fact that the right to collect tax could be inherited, bought and sold implied that they were not simply government officials.

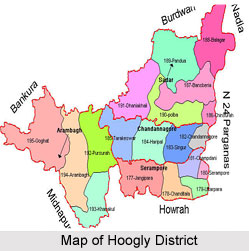

Nadia rose in the mid seventeenth century. Bardhaman accumulated huge valuable holdings from the end of the seventeenth century. In the early eighteenth century Rajshahi and Dinajpur absorbed several smaller zamindars. The growth of several great zamindars is associated with Murshid Quli Jafar Khan. In 1728 more than a quarter of the nominal revenue of Bengal depended on the zamindars of Bardhaman and Rajshahi. Towards the end of the Nawabs` rule 60 per cent of revenue came from fifteen zamindars. According to the Nawabs, concentration of resources in a few hands simplified the problems of gaining the revenue efficiently. However it created difficult power blocs within Bengal whose loyalty was not completely assured.

Taxation would flow only in conditions of order and stability. It was in the zamindar`s interest and his duty to guarantee order and stability. In order to enforce revenue collections and preserve order a zamindar maintained powerful forces. The police were supported by lands allocated to them in the villages.

The Mughal government had to employ agent collectors to handle the payments from small zamindars. Some of them were other officials appointed by the government; others were chiefs of the Rajput clans and Bhumihars. In both cases there was a trend towards turning their duties to collect for the government into property for themselves. Government collectors tried to win acceptance as great zamindars with permanent rights.

The revenue paid to the Nawabs of Bengal or to the holders of jagirs came from different intermediaries. In plains of western and central Bengal zamindars were responsible for huge payments from extensive areas.