The functions of the Indian Postal Service are varied and serve different sectors but their primary purpose is to provide mail services to the customers. Their other services include financial, philately, counter and e-posts. Discussed elaborately below are some of the functions of Indian Postal Service:

The functions of the Indian Postal Service are varied and serve different sectors but their primary purpose is to provide mail services to the customers. Their other services include financial, philately, counter and e-posts. Discussed elaborately below are some of the functions of Indian Postal Service:

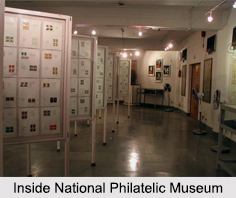

Philately: The basic concept of philately is the collection and study of postage stamps and the first philatelic society in India was founded in Calcutta on March, 1897. The functions of philately include design, printing and distribution of special or commemorative postage stamps, definitive postage stamps and items of postal stationery. It also includes promotion of philately, conduct of philatelic examinations at the national level, participation in international exhibitions and monitoring exhibitions at the state, regional and district levels and maintenance of the National Philatelic Museum.

The museum had its beginnings at a meeting of the Philatelic Advisory Committee on September, 1962 and was finally inaugurated on July, 1968 in Delhi. The National Philatelic Museum displays a number of frames exhibiting stamps from independence and post- independence era like from the Convention and Feudatory States along with postal stationery and other thematic collections. After its renovation, the Department of Posts inaugurated the National Philatelic Museum on July, 2011.

The Indian Postal Service has also developed software for philatelic inventory management, which is known as "Philsim". The software is used for all activities related to philately, including forecasting, indenting, invoicing, monitoring supply and demand. Philsim also records sales and revenue for commemorative stamps and other philatelic products at philately bureaus and counters.

The Indian Postal Service has also developed software for philatelic inventory management, which is known as "Philsim". The software is used for all activities related to philately, including forecasting, indenting, invoicing, monitoring supply and demand. Philsim also records sales and revenue for commemorative stamps and other philatelic products at philately bureaus and counters.

Army Postal Service: Functioning as a government operated military mail in India; the Army Postal Service has been in service for almost 163 years. One of the primary features of the Army Postal Service is that they are normally subsidized to ensure that military mail posted between duty stations abroad and the home country or vice versa does not cost the sender any more than normal domestic mail traffic.

Electronic Indian Postal Order: First introduced on March, 2013, the Electronic Indian Postal Order or e-IPO was initially only for citizens living abroad. From February, 2014 onwards, the service was expanded to include all Indian citizens. Under the Right to Information (RTI) Act of 2005, the postal orders can be used for online payment of fees for access to information.

Postal Life Insurance: With an express approval of the Secretary of State to the Queen Empress of India, the Postal Life Insurance was introduced on February, 1884 and is one of the oldest life insurers in India. When it first started, it was essentially a welfare scheme for the benefit of postal employees but by 1888, it extended to the employees of the Telegraph Department as well. Eventually from 1894, the Postal Life Insurance also started to cover female employees of both postal and telegraph departments, when no other company would cover for female employees.

Currently, the insurances covered under this scheme are Suraksha, Santosh, Suvidha, Yugala Surksha, Sumangala, and Children"s policy. In 1995, the Indian Postal Services had also started Rural Postal Life Insurance (RPLI) for the rural public, which included Gram Santosh, Gram Suraksha, Gram Suvidha, Gram Sumangal and Gram Priya.

Postal Savings: The Indian Postal Service offers several savings plans including Recurring Deposit Account, Sukanya Samriddhi Account, National Savings Certificates, Kisan Vikas Patra, the Public Provident Fund, savings- bank accounts, monthly-income plans, senior-citizens` savings plans and time-deposit accounts. The vast network of the Indian Postal Services has been used to disburse payments under National Rural Employment Guarantee Act.

Banking: A Government of India owned payment bank, the India Post Payment Bank operates under the Indian Postal Services. It aims to utilize all of India`s 155, 015 post offices as access points and 3 lakh postal postmen and Grameen Dak Sewaks to provide house to house banking services. This was inaugurated on September, 2018 by Prime Minister Narendra Modi. This banking system offers services like savings accounts, money transfer and insurances through the third parties, bill and utility payments.

Data Collection: Collaboration between the Ministry of Statistics and Programme Implementation and the Department of Posts has enabled the computation of consumer-price indices for rural areas. This alliance authorises the Indian Postal Service to collect data on paid prices for selected consumer goods. A monthly publication of this information is done based on the available data from 1, 181 villages across the country.

E-Commerce Delivery: With changing times and the popularity of e-commerce, the Indian Postal Service has partnered with major e-commerce portals for delivering prepaid as well as Cash on Delivery (COD) parcels. The postal department`s revenues by ways of COD consignments from e-commerce majors have more than doubled in the first 9 months of fiscal year 2015-16 at 10 billion.

The other functions of the Indian Postal Service are similar to that of the services of post offices.