The economy of the Rashtrakuta dynasty subsisted, owing to its agricultural and natural produce, money attained from its subjugations and the manufacturing revenues. Cotton was the principal crop of the regions of southern Gujarat, Khandesh and Berar.

The economy of the Rashtrakuta dynasty subsisted, owing to its agricultural and natural produce, money attained from its subjugations and the manufacturing revenues. Cotton was the principal crop of the regions of southern Gujarat, Khandesh and Berar.

Tagara, Minnagar, Ujjain, Paithan and Gujarat were significant centers of the textile industry. Muslin cloth was contrived in Paithan and Warangal. The cotton yarn and cloth was exported from Bharoch. White calicos were manufactured in Burhanpur and Berar and exported to Persia, Turkey, Polland, Arabia and Cairo. The Konkan district, feinted by the feudatory Silharas, formed large quantities of betel leaves, coconut and rice while the lush forests of Mysore, reigned by the feudatory Gangas, produced such woods as sandal, timber, teak and ebony. Incense and perfumes were exported from the ports of Thana and Saimur. The Deccan soil, although not as abundant the Gangetic plains, was affluent in mineral deposits. The copper mines of Cudappah, Bellary, Chanda, Buldhana, Narsingpur, Ahmadnagar, Bijapur and Dharwar were an important source of income and played an important role in the economy.

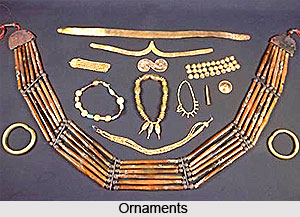

Diamonds were mined in Cudappah, Bellary, Kurnool and Golconda; the capital Manyakheta and Devagiri were important diamond and jewellery trading centres. The leather and tanning industry prospered in Gujarat and several regions of northern Maharashtra. Mysore with its vast elephant herds was important for the ivory industry. The Rashtrakuta Empire controlled most of the western sea board of the subcontinent which facilitated its maritime trade. The Gujarat branch of the empire earned a significant income from the port of Bharoch, one of the most prominent ports in the world at that time. The empire`s chief exports were cotton yarn, cotton cloth, muslins, hides, mats, indigo, incense, perfumes, betel nuts, coconuts, sandal, teak, timber, sesame oil and ivory. Its major imports were pearls, gold, dates from Arabia, slaves, Italian wines, tin, lead, topaz, storax, sweet clover, flint glass, antimony, gold and silver coins, singing boys and girls (for the entertainment of the royalty) from other lands.

Trading in horses was an important and profitable business, monopolized the Arabs and some local merchants. The Rashtrakuta administration tariffed a shipping tax of one golden Gadyanaka on all foreign vessels boarding to any other ports and a fee of one silver Ctharna (coin) on vessels traveling locally. Artists and craftsman functioned as corporations (guilds) rather than as individual businesses. Inscriptions mention guilds of weavers, oilmen, artisans, basket and mat makers and fruit sellers. Saundatti writing refers to a throng of all the citizens of a district headed by the associations of the province. Certain guilds were considered higher than others, just as some corporations obtained majestic charters shaping their authority and rights. Writings indicate that the guilds comprised of their individual mercenaries in order to defend goods in transit and they operated banks that lent money to traders and businesses, akin to village assemblies.

The five principle sources that fetched the government`s revenue were regular taxes, occasional taxes, fines, income taxes, miscellaneous taxes and homage from feudatories.

Income tax incorporated taxes on crown land, wasteland, specific types of trees considered valuable to economy, mines, salt, treasures unearthed by prospectors. A crisis tariff was obligatory seldom and applicable when the kingdom was under coercion, such as natural calamities, or preparing for war or overcoming war`s damages. Furthermore, customary presents were bestowed to the king or majestic officials on such festive occasions as marriage or the birth of a son. The king resolute the tax levels based on need and circumstances in the kingdom while ensuring that an undue burden was not placed on the peasants. The landlord or tenant paid multiplicity of taxes, including land taxes, produce taxes and payment of the overhead for maintenance of the Gavunda (village head). Land taxes differed, on the basis of the type of land, its produce and situation and arrayed from 8% to 16%. A Banavasi inscription of 941 mentions reassessment of land tax due to the drying up of an old irrigation canal in the region.

The land tax may have been as high as 20% to pay for expenses of a military frequently at war. In most of the kingdom, land taxes were paid in goods and services and were rarely accepted in cash. A portion of all taxes earned by the government (usually 15%) was returned to the villages for maintenance. Taxes were levied on artisans such as potters, sheepherders, weavers, oilmen, shopkeepers, stall owners, brewers and gardeners. Taxes on consumable items such as fish, meat, honey, medicine, fruits and essentials like fuel was as high as 16%. Taxes on salt and minerals were obligatory even though the kingdom did not assert solitary possession of mines, implying that personal mineral panorama and the quarrying business were possibly active. The state claimed all such properties whose deceased legal owner had no immediate family to make an inheritance claim. Under miscellaneous taxes were ferry and house taxes. Only Brahmins and their temple institutions were taxed at a lower rate.