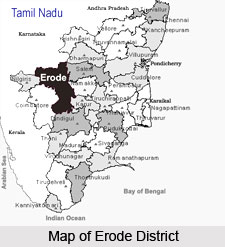

We always assume that India has adopted the taxation system from the British. However, the tax system existed even during the Chola period in ancient times. Only Value Added Tax and Fringe Benefits Tax were not in existence in those days!

Since the kings fought amongst themselves they needed a lot of money for maintenance, even during the Sangam period (before the 5th century A.D). The subsequent Pallavas and the Imperial Cholas and Pandyas because of their vast empire, sometimes comprising the whole of South India and also a part of Sri Lanka and Maldives, and their campaigns up to the Himalayas and Indo-China via Burma and their constant fights also needed a lot of money. So was Vijayanagar with its vast empire covering the whole Indian peninsula, Deccan and parts of Burma and Sri Lanka. In fact, taxation was considered rather harsh during the declining period of the Imperial Cholas and the Vijayanagar period.

The most important tax was Land Revenue with 1/6th of the produce as the king`s share. In fact, this would haunt all regimes right through history including the British and after Independence till its importance declined and it was eventually abolished - Bacchins (excise duty on liquor) and sales tax took over! Sangam literature referred to this king`s share and it was paid in cash or kind into the king`s treasury. There were also officials to collect it. Although the Tirukkural did not refer to the share directly, the commentator on Rural, Parimelalagar feels that there was an oblique reference to it. But, it was not clear whether these l/6th shares of the king referred to only the income from land or also from other sources i.e. total income of the subject and also whether it referred to the net or gross income but it was there!

It became half during the Vijayanagar period so much so a foreign diarist in Vijayanagar made fun of Krishnadeva Raya that he needed this money to maintain his 12000 wives! But actually the major portion of the revenue was for defense purposes as it is even now- 30%! The expenditure on the king and his entourage was much less because administration was also hired. Some important taxes of the South India of those days included:

Kadamai - Land Revenue - paid to the king.

Kudimai - is the obligation of the tenant. Also general term denoting all taxes except, Land Revenue.

Irai or Antharayam - Cash levy on tenants.

Some Pallava Taxes were as follows

1. Salt Tax.

2. No concrete evidence of land tax, but private ownership of land was allowed.

3. Tax on professional toddy tappers -Different rates on fresh toddy and sweet toddy.

4. Tax on cattle breeders.

5. Professional taxes on barbers, washerman (Professional as well as for the state tank, water and stone!), goldsmiths, blacksmiths, potters, village-weaver (on ton, profession etc.) brokers {tarakars), oil mongers, etc.

6. Brahmanarasakanam: tax payable by the Brahmin priests to the kings.

7. Taxes on animals owned, trees, wells, etc. These Pallava and early Chola taxes were called vain, ay am, kanam, dandam, korai kadamai etc.

During the Vijayanagar and Imperial Chola periods tax burden became worse, the list of taxes being long and several hundreds of them like on marrying parties, pandals (Krishnadeva Raya abolished this), on dancing girls, prostitutes (permissible, but not adultery), painters, shoemakers and even on pardesis for the tents pitched by them!

Non-payment of tax due to kings was severely punishable.

A few examples of Imperial Chola, Pandya and Vijayanagar taxes

1. Dues for the king`s coronation ceremony.

2. Tax paid towards minting coins (goldsmi ths used to do this, but is was made a governmental function exclusively - a Royal Mint - in Vijayanagara rule).

3. Dues for survey of lands and several other such dues.

4. Poll - tax (magazine).

5. Local cess on bazaar or market - fee.

6. Penalty for unauthorized items of enjoyment?

7. Water cess.

8. Tax by local bodies.

9. Tax for maintenance of riverbanks.

10. Gift Tax.

11. Fee for crematorium.

12. Tax on ploughs.

13. Tax on betel trade and leaves.

14. House tax.

15. Land tax.

16. Tax on maherva oil cake.

17. Tax for maintenance of officials.

18. Sales tax.

19. Tax on guilds.

20. Tax on village accountants.

21. Quit-rent.

22. Fee for upkeep of the Treasury.

23. Fee for police duties,

24. Tax for growing water lily (kuvalai).

25. Tax on Industry.

26. Tax on an ornament worn on the forehead!

27. Brokerage for pepper trade.

28. Fee for issue of Royal Charter and fee for torn - toming it!

29. Tax on persons who enjoyed the status of a prince! etc.

During the later periods, in the time of the late Nayaks and also under the British Zamindari system, areas were given to people to collect taxes and the collectors kept a share for themselves.